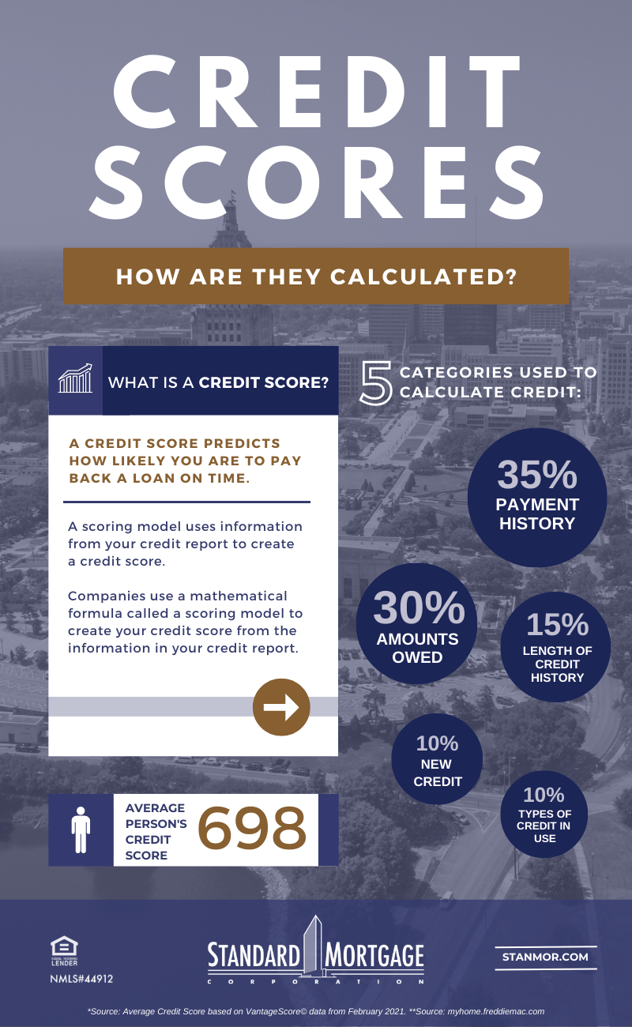

Your credit score is your ticket for borrowing money. Your track record of making timely payments, using money responsibly, and keeping the amount of money you owe to a minimum are a few of the factors that can improve and enhance your credit rating. The higher your credit score, the more likely you are to not only receive financing for large purchases like a car or home; you can also benefit from lower interest rates, saving you money over the life of your loan. Lenders use your credit score which is collected from and monitored by different agencies. The three main credit bureaus are Transunion, Experian, and Equifax. There are several factors, reporting periods, and updates that are unique to each bureau, which is why mortgage lenders use a variety of information to create a credit model that provides them the information they require to estimate how likely you are to make your monthly payments on time. These reports also shed light on your spending and savings habits, offering potential lenders further insight into the information they need to make a decision. This infographic breaks down the key factors that go into determining a credit score, and how you put your financial history and performance in the best position to obtain a mortgage and other financing.