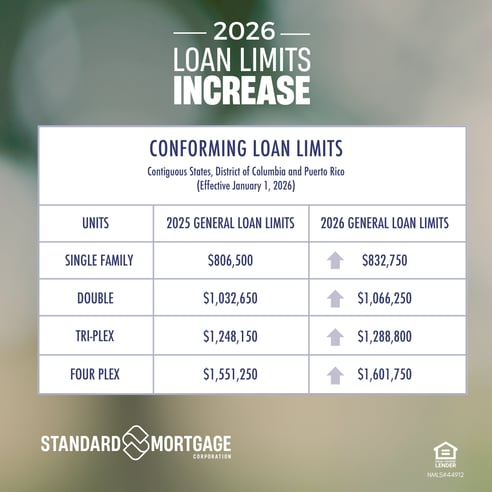

The Federal Housing Finance Authority (FHFA) recently released updated 2026 conforming loan limits. Beginning January 1, 2026, the conventional loan limit will increase by 3.26 % to $832,750 for a single-family home in the 48 contiguous states. The maximum amount in 2025 was $806,500.

How Loan Limits Impact Homebuyer Affordability

Loan limits directly influence your buying power, the mortgage programs you qualify for, and what you’ll pay both upfront and long-term. With the 2026 conforming loan limit rising to $832,750 in most areas and even higher in designated high-cost markets, many buyers can now finance more home while still accessing conventional, government-backed loans.

Remaining within conforming loan guidelines can offer meaningful benefits for the majority of buyers. These loans generally come with more flexible qualification criteria, competitive interest rates, and access to widely used programs, including many designed for first-time home buyers.

What Conforming Loan Limits Are and Why They Matter

Conforming loan limits define the maximum mortgage amount that Fannie Mae and Freddie Mac, the two major government-sponsored enterprises (GSEs), are allowed to purchase from lenders. After your loan is funded, many lenders sell these mortgages to the GSEs to free up capital and continue issuing new loans. This system keeps the housing market stable, ensures consistent underwriting standards, and helps maintain broad access to conventional financing.

Loan limits are adjusted each year based on factors that reflect real-time market conditions:

- Regional Housing Costs: High-cost areas receive higher limits to match elevated home prices.

- Market Conditions: Rising home values, inflation, and broader economic trends often lead to annual increases in conforming loan limits.

Together, these elements ensure loan limits remain aligned with current pricing trends, allowing buyers to access financing that accurately reflects today’s housing market.

Loan Limits Vary by Mortgage Type

Different mortgage programs use different loan limits, and understanding those distinctions is key to choosing the financing that fits your budget and goals.

- Conventional Loans: Backed by Fannie Mae and Freddie Mac, these loans are capped at the annual conforming limit set for each county.

- FHA Loans: Limits vary by location and are often lower than conventional loans, though high-cost areas may offer higher allowances.

- VA Loans: Eligible veterans with full entitlement typically face no loan limit, though lenders still review the borrower’s overall risk profile.

- Jumbo Loans: Any loan amount above the conforming limit is considered a jumbo loan.

These limits affect several aspects of the mortgage process, including your interest rate options, down payment and closing cost requirements, and overall loan eligibility. Homes priced above conforming thresholds may lead you toward jumbo financing or require a larger upfront investment to stay within conventional guidelines.

Understanding loan limits is an essential step in planning your home purchase, as it helps you avoid unexpected costs, compare options with confidence, and select the financing strategy that best supports your long-term homeownership goals.

Whether you're a first-time buyer or exploring refinancing options, the Standard Mortgage team is here to help you navigate your choices with clarity and confidence. Contact us today to get started.